Solar canopies are an asset to businesses because they elevate the client experience, reducing vehicle temperatures by up to 30% and lowering vehicle surface temperatures by 50%. Solar-covered parking can also help businesses reach sustainability goals and generate power on property they already own.

Grants and incentives are designed to help businesses make eco-friendly decisions with financial support. Solar canopy incentives all have different requirements, and some grants phase out or are reduced over time.

Learn more about the options available for companies that want to invest in solar canopies for parking lots.

Federal Tax Credits

Because the federal government wants to support sustainable energy, there are various federal tax credits available for commercial solar carports. It’s important to note that federal tax credits are subject to change and often have a time limit.

Here’s an overview of the top federal tax credits for solar-covered parking solutions in 2025.

Investment Tax Credit (ITC) for Solar and Storage (48/48E)

The most well-known credit for solar-covered parking structures, the ITC covers energy storage installed with or without canopies. It’s essential to note that commercial ITC is phasing out, so companies should take action immediately to benefit from this credit. Businesses can only claim the ITC in the year that they install and start using their solar panel system.

While the base rate for eligible projects is 6%, businesses can receive up to 30% back if their project meets prevailing wage and apprenticeship rules (PWA). PWA rules include:

- Paying DOL prevailing wages to laborers during construction

- Meeting apprentice labor-hour ratios for project workers

- Staying under 1 MWac to be exempt from PWA rules

If projects are under 1 MWac, they’re eligible for the full 30% back, even if they don’t meet PWA and apprenticeship requirements. However, not every project cost is eligible for tax credits.

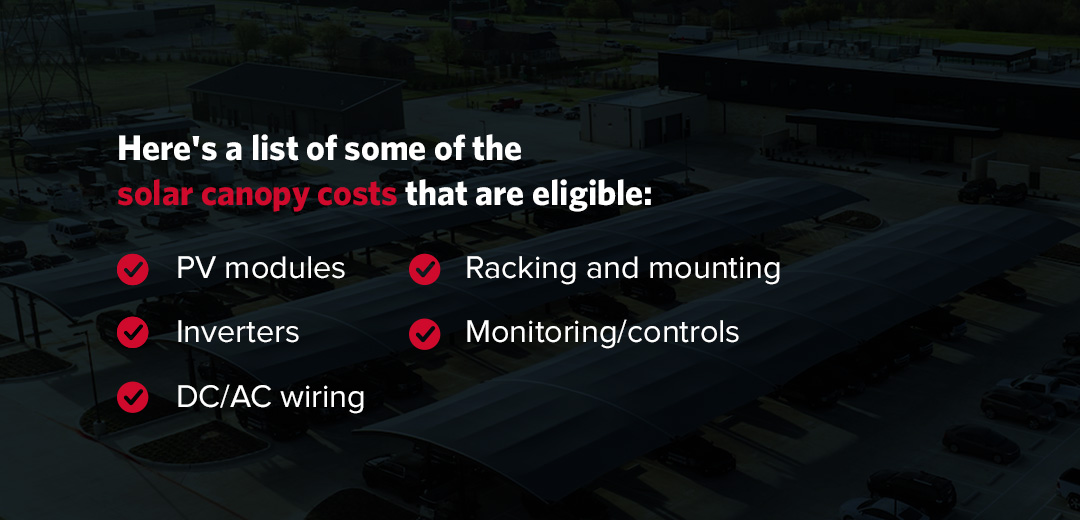

Here’s a list of some of the solar canopy costs that are eligible:

- PV modules

- Inverters

- DC/AC wiring

- Racking and mounting

- Monitoring/controls

Stand-alone battery storage is usually eligible, and some canopy structures may qualify. Businesses should work with tax counsel to ensure they report this correctly — sometimes they can use an engineering allocation to include foundational parts for the solar panel system.

To receive even more benefit, companies can stack the ITC with other tax credits like the Energy Community bonus and the Low-Income Communities Bonus. These bonuses allow for an additional 10% and 10-20%, respectively, so companies that qualify could receive 40% or much higher of the project cost back in tax credits.

Energy Community Bonus

This federal bonus can be stacked with the ITC for an additional 10% tax credit back on solar carport projects. The only requirement is that the project must be located in an energy community. There are several different communities that qualify, including:

- Brownfield sites.

- Areas with fossil fuel industries and low employment.

- Coal closure census tracts.

Companies can check to see if their project is located in an energy community by checking the Department of Energy and National Energy Technology Laboratory (DOE/NETL) Energy Communities map. Brownfield sites are not fully mapped out in this document, but businesses can check for the other two qualifying site types.

Companies can learn more about energy communities and what qualifies on the Internal Revenue Service (IRS) website. To prove they are located in an energy community, businesses will have to demonstrate that at least 50% of the project’s nameplate capacity, or power output, is in an energy community. If projects are thermal or storage-related, at least 50% of the project’s square footage must be located within an energy community.

Low-Income Communities Bonus

Companies can get an even higher percentage of costs back if they stack the Low-Income Communities Bonus onto the ITC. This bonus can amount to 10% or 20% more in addition to the 30% that companies can receive back from the ITC.

This credit is for developers of clean electricity projects like solar canopies. To be eligible, projects must be under or equal to 5 MW AC. Projects must also fit into one of four categories:

- Category 1 is located in a low-income community and can receive 10 credit points

- Category 2 is located on Indian Lands and can receive 10 credit points

- Category 3 is a Qualified Low‑Income Residential Building Project that can receive 20 credit points

- Category 4 is a Qualified Low‑Income Economic Benefit Project that can receive 20 credit points

This is a competitive credit category, so not every business that applies will receive credits even if their project is eligible. Annual national capacity is at 1.8 GW DC per year as of 2025. These points are allocated across the four categories.

Although the 2025 application window closed on August 1, the 2026 window will open on the first Monday of February 2026.

Alternative Fuel Vehicle Refueling Property Credit (30C)

Electric vehicle (EV) charging equipment is typically filed under the 30C credit instead of the ITC. If companies report separate parts correctly, they can claim both the 30C and ITC credits, allowing them to get the maximum amount back for their project. Working with a tax professional is the best way to claim these credits.

The 30C credit, or Alternative Fuel Vehicle Refueling Property Credit, covers up to 30% of eligible EV charging equipment and installation. To be eligible, companies must meet PWA requirements, like with the ITC. This credit is capped at USD 100,000 per item if the equipment is located in a low-income or non-urban area.

Businesses that want to use this tax credit can access it through December 31, 2032. For this credit, single property items include each fuel dispenser, charging port, energy storage property, and labor costs for the construction and installation of electric vehicle chargers. Each item can receive up to 30% back in tax credits if it meets PWA requirements.

State Grant Programs

States also offer incentive programs for solar canopies. These grants vary considerably, but they’re a strategic part of funding. Some of the most prominent state solar canopy grant programs are listed below, with more details about each.

Maryland Energy Administration (MEA) Grant and Commercial Solar Grant Program

The MEA grant was a valuable solar canopy electric vehicle infrastructure grant. This state program offered grants for solar installations on existing public facilities. Projects that include EV chargers were also eligible.

The MEA solar canopy infrastructure grant program will wrap up by 2026. Instead, canopy funding will shift to the Commercial Solar Grant Program — a grant for solar photovoltaics systems benefiting businesses in the state.

Massachusetts SMART Canopy Adder

In Massachusetts, the SMART program pays a per-kWh incentive for eligible solar projects in investor-owned utility territories. Solar canopy projects can receive “adders,” or additional per-kWh incentives. Under legislation in 2025, the canopy adder in MA is USD 0.08 per kilowatt-hour (kWh).

To be eligible, projects must qualify as SMART Solar Tariff Generation Units and meet the official definition of a canopy. SMART 3.0 has an annual capped program capacity, so not every business that applies will benefit. However, it’s definitely worth applying! To apply, companies must go through the SMART portal and register their utility territory.

New Jersey ADI and CSI Programs

In New Jersey, the Administratively Determined Incentive (ADI) programs, such as the Successor Solar Incentive (SuSI), offer administrative incentives for several kinds of projects. These include nonresidential net-metered projects that are under 5 MWdc.

To apply, companies must register their projects in the ADI portal. After the project is set up, companies can use this portal to track energy generation and receive SREC-II payments. Fixed payment amounts can vary depending on the project and the year.

If projects are over 5 MWdc, companies can register them under the SuSI and Competitive Solar Incentive (CSI) program instead. This is a competitive, bid-based incentive program for large solar projects in the state. Companies that qualify can watch for the CSI solicitation window — in 2025, this window runs through September 30, 2025. To apply, they should prepare their bid package and register in the CSI portal, then submit their bid before the deadline.

New York Sun Program

This state program is run by the New York State Energy Research and Development Authority (NYSERDA) and offers upfront incentives for homes, businesses, and nonprofits in New York. To benefit, businesses must first find a NY-Sun participating contractor. Contractors can apply the incentive and then offer companies an upfront price that reflects the incentive. This program encourages businesses and contractors to choose solar energy.

Different installers have separate rules and incentives within this program, so businesses should check with their installers for details. Incentive levels can also change, so it’s essential to check the official dashboard before pricing projects out. For solar storage incentives, companies should consider NYSERDA’s battery programs and utility tariffs. Companies can ask their contractors about these programs.

How to Find Additional Local and Utility-Specific Incentives

Companies that want to learn about incentives for their state can search the Database of State Incentives for Renewables & Efficiency (DSIRE). This is the most comprehensive source for learning about state rebates, tax credits, grants, and incentives. Businesses can search the database by state and then filter for solar commercial projects.

In addition to state programs, there may also be municipal grant programs or private sector partnerships that can support businesses when they install solar canopies. The more grants and incentives businesses can find, the more affordable solar canopies will become.

Once canopies are installed, they can generate energy for a high return on investment (ROI).

How to Maximize Grants and Incentives

Companies can use several strategies to find the most comprehensive support for their solar canopy projects. With the right planning, solar canopies can be an affordable investment that benefits businesses for the long term. Below are several ways businesses can handle grants and incentives for the best outcome.

Stacking

Grants and incentives can be stacked so companies can benefit from multiple incentives for the same project. It’s best practice to start with the 48/48E ITC federal tax credit, partly because it’s often the most impactful grant. Some projects may qualify for additional ITC bonuses like the Energy Community Bonus.

Once companies have received grants at the federal level, they can apply for state-level grants for additional support. Every state has different programs for solar energy, so the best program will depend on where companies are located and what’s available. Utility performance incentives and SREC programs can offer even more support for solar canopy projects.

EV and Solar Canopies

If a company’s project includes EV charging and solar canopies, they can unlock support from 30C as well as 48/48E. The same clients who appreciate solar canopies also tend to value EV charging stations, so installing both together can be a wise move for many companies.

Similar to 48/48E, 30C has specific labor law requirements written into its code. Before factoring in support from 30C, businesses must ensure they meet all requirements. Careful planning can help companies reach their sustainability goals, please clients, and generate solar energy to power their facilities.

Prevailing Wage and Apprenticeship

To ensure they can receive the full 30% tax credit rate from ITC and 30C, businesses must meet prevailing wage (PWA) and apprenticeship requirements. Projects that are small may qualify for the small project exception and receive the 30% tax credit rate without meeting these requirements.

However, businesses that are planning large projects should carefully consider PWA and apprenticeship requirements to ensure they receive the most financial support. With a few essential changes, installing solar canopies can become much more accessible for companies.

In addition to finding grants, it’s essential for companies to consider both the long-term cost of maintenance and site repair. While grants and incentives equip many businesses to invest in solar initially, these financial support systems don’t cover repairs or replacements. Planning for installation is just the first step in having a wise financial plan.

Cover Parking With Solar-Enabled Canopies From VPS

In addition to generating energy for company utilities, solar canopies provide shade and protection for vehicles parked on-site. They improve the client experience and aesthetics of a company’s property. Finding the right grants and incentives can make solar-enabled canopies more affordable upfront for companies, making it possible to install and benefit from them sooner.

VPS has been serving clients with the highest quality in vehicle protection structures for over 30 years. We’re the industry leader for parking canopies and offer a range of models, including metal and fabric options.

Our metal canopies can be paired with solar panels for a sustainable way to generate electric power while protecting vehicles from heat and weather damage.

Contact VPS for a Quote Today

At VPS, we’re known for our clear communication, durable materials, and attention to detail. We treat each project like it’s our first and last opportunity to wow our clients. There’s never been a better time than now to invest in solar parking canopies, especially with the ITC phasing out around the end of 2025.

Contact us today for a project quote and to learn more about our services!